The Balance Sheet: a weekly diagnosis of our economy’s health

Why This Comes From Me

The first question many people ask when they see The Balance Sheet on a site full of photojournalism is: how can a photographer come up with something like this — and why should I trust it?

The simple truth is that I’ve been misunderstood most of my life, pigeonholed as “just a photographer.” But I was never just that. Long before I carried a camera, I was an avid reader, doing binary math before kindergarten, playing ranked chess, and growing up in a family of mathematicians, engineers, machinists, and artists. Systems fascinated me.

When I became a photojournalist, it wasn’t because I made pretty pictures, it was because I was a journalist. I’ve always been curious, always been empathetic, and always believed that people deserve to see how the hidden mechanics of the world shape their daily lives. Translating complexity into images is hard, you can’t make a truthful picture unless you first understand the system behind it. That’s been the way I work from the start: studying, researching and investigating to break down mechanisms in order to show their human consequences in a way that people can easily understand them. Photojournalism also meant that I needed to be present. To witness. And when you do that and you actively listen, the world explains itself vividly.

Take my reporting at Orb Media on the Global Findex, where we built a predictive model of who could come up with emergency money. It wasn’t enough to quote numbers; I had to question the data, understand the feedback loops, and take it global. I interviewed heads at the World Bank, the Bank of Brazil, and the UN , and then I put boots on the ground to show how access to credit shaped real lives. That’s what I’ve always done: study systems deeply, then communicate them clearly and humanely.

I see economics the same way, not as a straight line as many economists or businesses reports do. I see the economy as a complex system of cells. The economy works like a body, but not just at the surface level. Each household, each business, each sector is like a cell. And just as cells rely on mitochondria to turn fuel into energy, economies rely on flows of wages, credit, demand, and trade to stay alive. A healthy cell supports the tissue around it, but a weak or starving one drags its neighbors down. When enough cells fail, the organ falters and the whole body shows symptoms . Sickness. Exhaustion. Crisis. That’s why headline numbers can mislead. GDP might say the body is strong, but if the cells are running out of energy, the vitality isn’t real. To know whether the patient is thriving or just surviving, you have to bring out the microscope and look at everything from a cellular level.

Finally, my point with The Balance Sheet isn’t political, it is to use this somewhat unique model to prepare us all for what might be coming. With knowledge we can make informed decisions. And this knowledge isn’t based on spot news business headlines, it is based on a better understanding of our living economic body.

Other economists who share this understanding of the body economy

The Balance Sheet builds on a lineage of economists who argued that economies are living systems, not just numbers in a spreadsheet. Hyman Minsky warned that financial stability often hides fragility until it breaks, like arteries that seem clear until a clot suddenly stops the heart. Charles Kindleberger showed how small speculative fevers can ripple into manias and crashes, the way a single infection such as rabies can overwhelm the body. Joseph Schumpeter described capitalism as an organism in constant creative destruction, a process of renewal that can also metastasize like cancer. Friedrich Hayek argued that the true signals of an economy live in millions of small and local decisions that aggregates cannot capture. That insight echoes my own lived experience in untangling the complexities behind what we call the body economy. Elinor Ostrom revealed how ecosystems and communities fail when their smallest institutions decay, proving that the body is only as strong as its cells. Economists at the Santa Fe Institute have shown that what matters most are the interactions between agents, the circulation between cells that creates life, rather than the simple averages.

What unites them, and what grounds my own beliefs about economic study, is the idea that economies are ecosystems: complex, fragile, adaptive, and alive. They are at once interdependent and independent, each part needing the others yet capable of collapse when left on its own.

Where my model and economic understanding sometimes diverge

Mainstream economics often treats the economy as a straight line: GDP grows or contracts, inflation rises or falls, unemployment ticks up or down. These numbers matter, but they flatten the organism into one vital sign. Linear views struggle to explain how shocks spread, why confidence collapses faster than output, or why inflation feels worse than the official print.

My approach looks deeper. The economy is not a line on a chart but a body made of cells. Health depends on how energy flows through those cells and how they interact. When those flows weaken, stress spreads, often long before it shows up in headline numbers. That cellular view, rooted in lived systems rather than linear aggregates, is what makes The Balance Sheet different.

Where There May Be Holes

My model lacks access to the proprietary microdata hedge funds buy — daily payroll taxes, anonymized bank flows, satellite feeds. That limits precision.

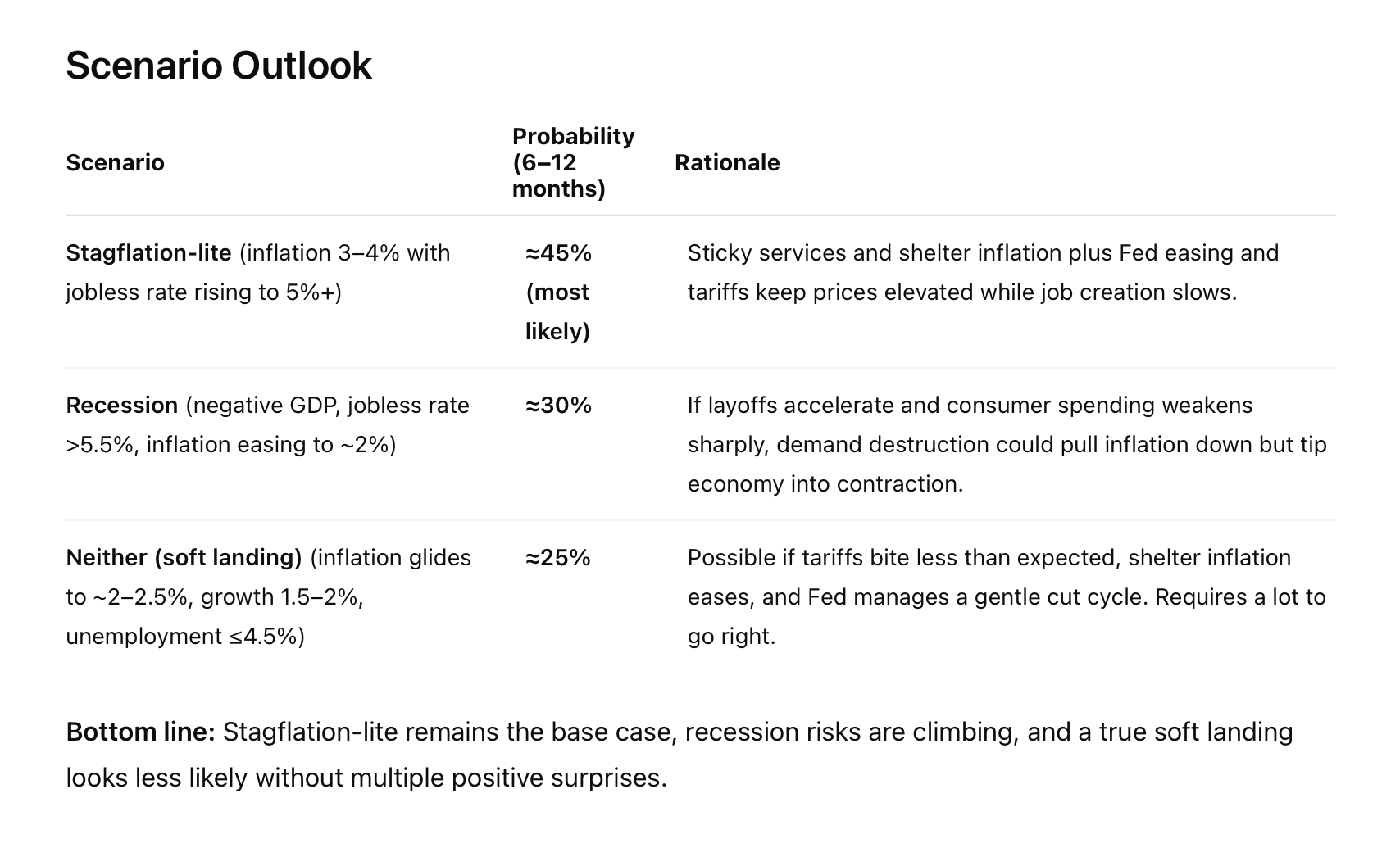

We don’t run DSGE or regression-heavy forecasting models. Our method is scenario-driven, not decimal-forecasted.

And because we blend headlines and behavior into analysis, the narrative can outrun the data if not carefully checked.

Where my model shines

What makes The Balance Sheet different is not just the data we track but how we connect it.

Systems thinking. Instead of waiting for official releases, we stitch together signals from credit spreads, freight indexes, rents, tourism flows, corporate earnings calls, consumer psychology, and numerous other systems. Seen together, these indicators give us a truer picture of health of our economy than any single data point.

Behavioral realism. We recognize that numbers alone don’t move economies — people do. When egg prices doubled, it wasn’t only bird flu driving inflation, it was human behavior. Hoarding amplified the stress, turning a small shock into a daily burden felt at every breakfast table. Building human psychology into our matrix isn’t just a differentiator, it’s essential to understanding how the economy really works.

Global interconnection. Economies do not stop at borders. A tariff in Washington, a port delay in Shanghai, or a power cut in Europe shows up in our body map as pressure points. We track how the cells interact across continents, because what happens in one organ can ripple through the entire body.

Examples of the accuracy of my model

In Q3 2024, official GDP reported that the economy was roaring at 4.9 percent. Our model read the cells differently: closer to 2–2.5 percent growth, fragile and uneven. A year later the record shows growth was not roaring at all. It slowed sharply in 2025, validating our systems view. Our approach is not about beating the government number on release day. It is about telling readers the truth of vitality: how healthy the body feels, where it is weak, and where the cancer may spread.

Another example comes from 2019. In Q3 of that year, the United States entered a little-reported manufacturing recession. The official GDP reports showed modest stability — 2 percent in Q2, 2.1 percent in Q3, and 2.3 percent in Q4. Running my model today, Q3 looks more like 1 to 1.3 percent, with Q4 effectively flat. At the time, I was already warning on social media that we were entering 2020 on shaky ground. I even reached out to The Washington Post business desk to argue that their reporting misrepresented realities on the ground.

We know what happened next. A virus acted as a catalyst that upended the global economy for years. With manufacturing already slowed, the pandemic simultaneously strained supply and unleashed massive demand. There was no easy way for the economy to come back into balance. The Fed had limited tools, and the one it used most aggressively — extraordinary liquidity — helped fuel the inflation that followed. Wage pressures also rose during the recovery as labor markets tightened, which further amplified price increases.

Our model would have predicted that any major disruption in late 2019 would have had dire, global consequences. And it did.

Disclaimer

The Balance Sheet is based on my independent reporting, analysis, and interpretation of economic signals. It is intended for informational and educational purposes only. It should not be taken as financial, investment, or legal advice. Readers should consult qualified professionals before making decisions about their own investments, retirement planning, or financial strategies.

Methodology & Sources

The economy is like a body. It isn’t just one number — it’s a collection of systems working together. Some are tightly linked, like the heart and lungs. Others seem separate, like skin and bones, but still keep the whole thing alive. When one system falters, the rest feel the strain.

Reading the Vitals

Most reports take one or two vital signs and call it a diagnosis — GDP, unemployment, inflation. We go deeper. Each week we examine the full body:

The heart (credit and capital): interest rates, bond markets, lending flows

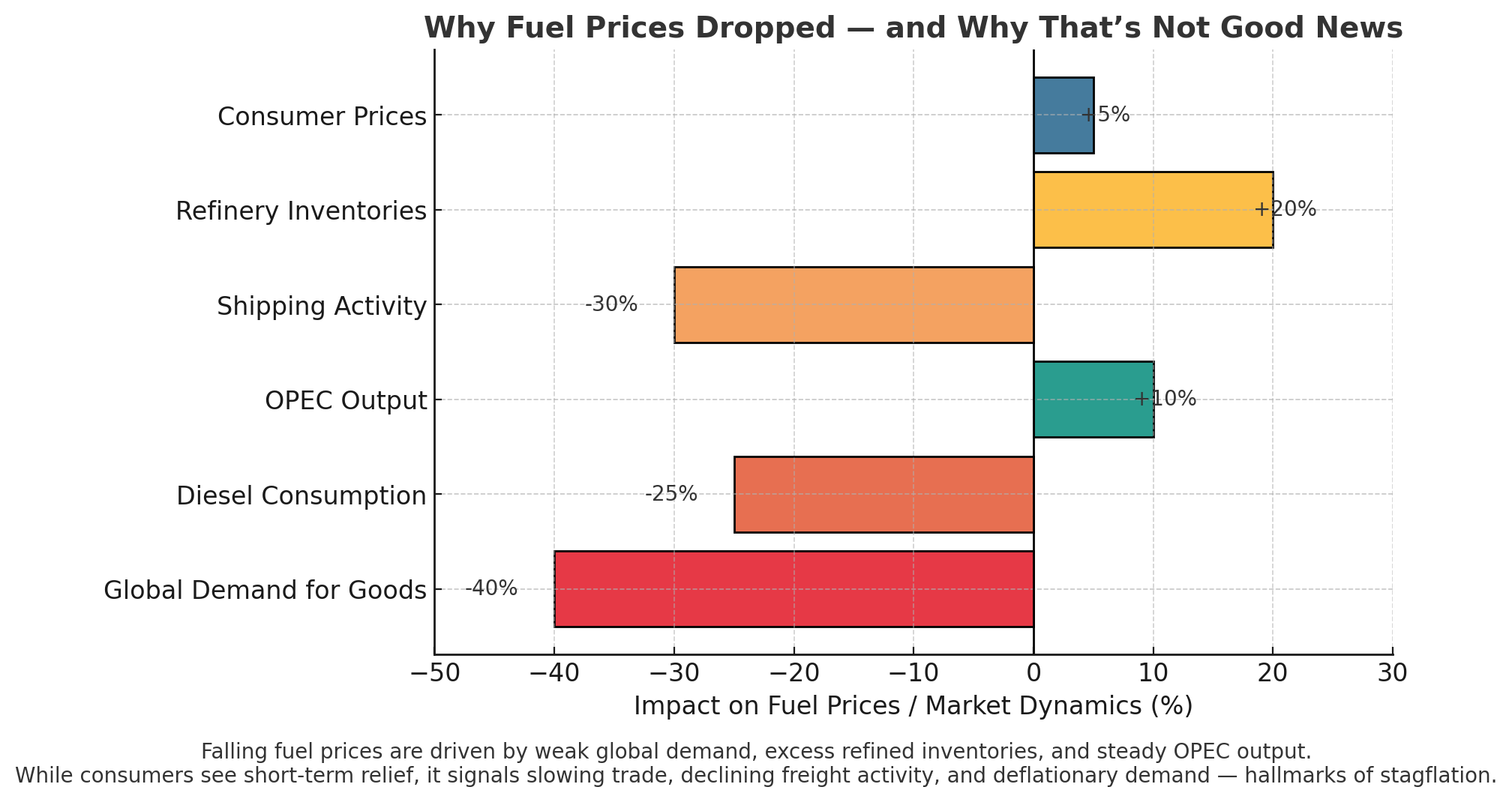

The lungs (trade and energy): exports, imports, shipping, oil and fuel costs

The brain (policy and expectations): Fed decisions, government actions, investor sentiment

The muscles (labor): jobs created, unemployment, wages, participation

The stomach (consumption): household spending, retail sales, confidence

The skeleton (housing and real estate): home sales, construction, commercial property health

The immune system (global shocks): tariffs, political instability, supply chain disruptions

Each system matters on its own, but it’s the feedback loops that shape the outcome. Rising fuel costs push up freight rates, which flow into retail prices, which chip away at sentiment, which eventually slows spending. We watch these chains closely to see how today’s wobble can become tomorrow’s wave.

Behavior Matters

Just like the body reacts to stress with a fever or inflammation, the economy reacts to headlines and fear. When eggs doubled in price during the bird flu outbreak, people rushed to hoard them. That panic made the shortage worse and turned inflation into something families felt every morning at the breakfast table.

That’s why we treat human behavior as part of the system itself. A single headline can magnify a disruption and change the direction of the economy faster than any spreadsheet suggests.

Why This Matters

It’s not enough to know the patient has a pulse. We need to know if the body is strong, fragile, or at risk of collapse. Our systems approach makes the economy less abstract and more human — and gives us a clearer view of what might come next.

Every Monday, The Balance Sheet brings you a full check-up:

Vitals: inflation, jobs, housing, trade, credit

Warning signs: which systems are wobbling and how those wobbles could spread

Tools for you: a Stagflation Index, Retirement Checklist, House-Sale Triggers, and global “Where Could We Land?” tracker

We don’t stop at numbers. We stitch data, headlines, and human behavior into a clear diagnosis — so you can see trouble sooner, plan smarter, retire safer, and stay resilient.

The Balance Sheet blends official releases, market signals, private data, and custom analytics. We track government statistics because they shape headlines and policy — but we never take them at face value. Every figure is cross-checked against alternative sources, sector indicators, and historical context to build a clearer picture of the real economy.

Core Economic Data

Market & Financial Indicators

Treasury.gov / FRED (St. Louis Fed) — yield curves, spreads, macro time series.

ICE/BofA — high-yield and investment-grade credit spreads.

S&P Global / ISM — manufacturing, services, composite PMIs.

University of Michigan / Conference Board — consumer sentiment and expectations.

Gallup Economic Confidence Index — consumer psychology complement.

Market-based inflation expectations — TIPS breakevens, 5y5y forward rates.

CBOE VIX & ICE BofA MOVE Index — equity and bond volatility.

Cass Freight Index / DAT load-to-truck ratio — freight and trucking activity.

Mastercard SpendingPulse / Adobe Digital Price Index — real-time retail and pricing trends.

Redfin, Zillow, CoreLogic, Case-Shiller (S&P), Apartment List — home prices, rents, mortgage dynamics.

OpenTable bookings, STR hotel occupancy, TSA throughput — travel and hospitality demand.

Baker Hughes rig count, Rystad Energy — private oil/gas activity trackers.

Real-Time & Alternative Indicators

ADP National Employment Report — private payrolls.

Paychex/IHS Markit Small Business Jobs Index — small-firm hiring.

Indeed / LinkUp job postings — labor demand (real-time).

Truflation / Billion Prices Project (MIT) — daily inflation trackers.

Google Trends — search activity on “recession,” “unemployment,” “mortgage refinance.”

Global & Trade Data

Baltic Dry Index / Freightos Baltic Index — global shipping costs.

Caixin China PMI — private measure of Chinese manufacturing/services.

Gro Intelligence / Rabobank — private ag/commodity insights.

FAO / UN Comtrade — global commodity trade flows.

OECD Composite Leading Indicators — harmonized international cycle comparisons.

Markit Global PMIs — cross-country economic activity benchmark.

China NBS / Eurostat — official cross-check on trade, industrial output.

Sector-Specific & Real-Economy Indicators

CMBS / Trepp — commercial real estate delinquency rates, especially office.

Moody’s / Fitch / S&P — credit ratings and sectoral risk signals.

Timber and hardwood exports — prices, demand (notably for China’s furniture industry).

Industry groups — American Soybean Association, National Hardwood Lumber Association, farm and forestry reports.

News & Policy Context

Reuters / AP / Bloomberg / Wall Street Journal / Financial Times — headline confirmation and policy updates.

Politico / The Hill / NPR — U.S. political and regulatory developments (trade, tariffs, Fed independence).

Regional press and trade outlets — AgWeb, Farm Policy News, local housing and tourism reports.

Custom Analytics

Stagflation Index — composite of CPI YoY + unemployment.

Structural Risk Index — traffic-light heat map of macro, labor, housing, and CRE vulnerabilities.

Retirement Defense Checklist — liquidity, withdrawals, insurance, debt readiness.

Early House-Sale Triggers — days on market, months’ supply, mortgage rates, insurance/tax shocks.

Where Could We Land? Tracker — country-by-country cost, visa requirements, and resilience analysis.

⚠️ Government-Reported Data (used selectively, flagged for transparency)

Bureau of Labor Statistics (BLS) — jobs reports, unemployment, CPI/PPI.

Bureau of Economic Analysis (BEA) — GDP, personal income/outlays, PCE inflation.

Federal Reserve & Atlanta Fed GDPNow — policy rates, yield curve, growth nowcasts.

U.S. Census Bureau — housing starts, new home sales.

National Association of Realtors (NAR) / Mortgage Bankers Association (MBA) — existing home sales, months’ supply, mortgage activity.

Department of Labor (DOL) — weekly jobless claims.

Energy Information Administration (EIA) — oil/gas production, price inputs.

USDA ERS / FAS — crop exports, farm income.

World Bank / IMF / OECD — comparative international data.

Note: These official sources are valuable for baseline measurement but subject to revision, political pressure, or lag. Our algorithm balances them with independent, private-sector, and real-time indicators to provide a clearer, more resilient pulse on the economy.