The past week brought two developments that matter more than the daily market chatter: the Federal Reserve cut interest rates for the first time this year, and President Trump signed an executive order restricting H-1B visas. One was a painkiller, the other a tourniquet. Together they tell a story of an economy being propped up for now but left with less room to heal.

The Fed’s cut buys short-term relief for households and businesses struggling under high borrowing costs. But paired with tariffs that continue to raise prices, the move risks keeping inflation stubborn even as growth slows — the classic stagflation trap. Investors cheered, but the underlying imbalance remains.

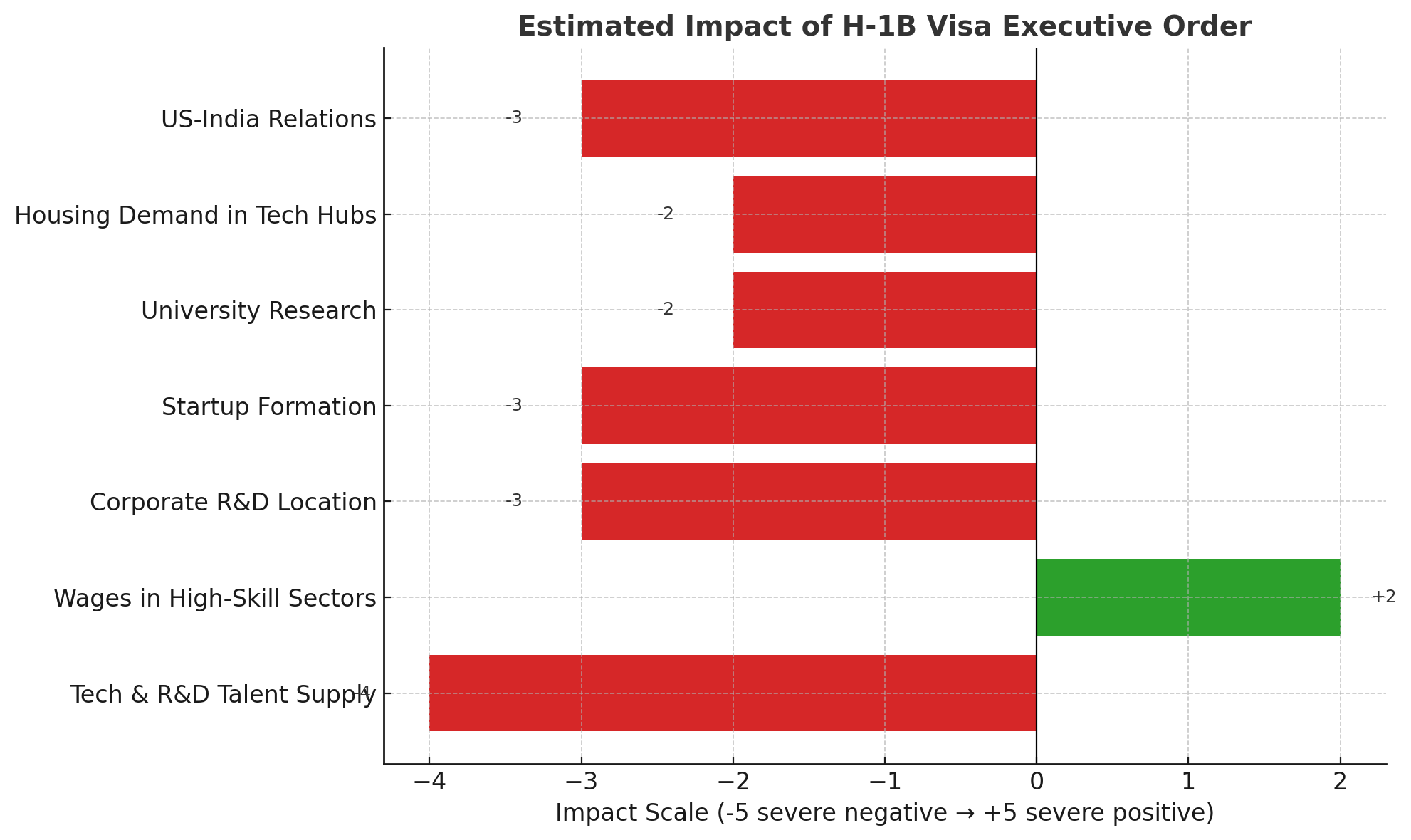

Wages increase because of the scarcity of high tech labor due to the EO but also because of lack of funding to research institutions by the administration.

The H-1B order cuts deeper. For decades, high-skilled immigrants, especially from India, have powered U.S. research, engineering, and medical progress. Shutting down that pipeline means companies will push more R&D abroad and the U.S. brain trust will slowly erode. It’s the kind of decision that doesn’t register in this quarter’s numbers but shapes the country’s trajectory for decades.

Meanwhile, the foundations of resilience — housing, cars, tourism, philanthropy — are softening. Homes are lingering on the market even as mortgage rates ease. Used cars are cheaper to buy but more expensive to repair. Hotels are reporting weaker bookings as summer closes. Even nonprofit giving, long a quiet stabilizer in tough times, is showing signs of donor fatigue.

Taken together, these headlines suggest an economy that’s still standing but increasingly brittle. AI investment is holding up the frame for now, but if that spending slows or global shocks hit, the cracks could widen quickly. The path forward is less about avoiding pain and more about whether the country can absorb it without breaking.

Vitals

Pulse (Labor): ADP shows sluggish job gains (+54k), mainly in health care and AI. Indeed/LinkedIn postings are flat. Wages rising 4.4% y/y keep pressure on costs.

Blood Pressure (Prices): Tariffs and food costs remain inflationary. Relief from cheaper oil (~$63/bbl) and lower freight rates, but sticky in core goods.

Oxygen (Consumer Demand): Pending home sales only +0.8% y/y. Mortgage rates ~6.3%. Households cautious; grocery bills and medical costs weighing.

Mobility (Housing/Autos): Housing inventory rising, making it the “strongest buyer’s market in years.” Wholesale used car prices flat; repair costs up.

Circulation (Logistics/Tourism): Trucking spot rates subdued. Hotel RevPAR down in September, signaling softer travel demand.

Stress Test (Markets/Credit): HY spreads at ~2.7–2.8% (calm). VIX ~15–16. Equities still propped up by AI investment.

Doctor’s Notes

Diagnosis: Without AI spending, the economy would already look stagflationary. Growth is weak, prices sticky.

Symptoms: Fed cut 25 bps = short-term relief, long-term inflation risk. Trump’s H-1B EO curbs talent inflows, accelerating R&D migration abroad. Philanthropy softening and donor fatigue reduce community resilience.

Treatment Plan: Households: build cash, reduce leverage. Businesses: hedge supply chains, prepare for labor gaps. Policymakers: tariff relief and immigration clarity needed but unlikely.

Risk Factors: Expanded tariffs, AI investment slowdown, Fed credibility strain, housing inventory spike, sharper nonprofit pullback.

Composite Reading

Stagflation probability: 40%

Recession probability: 25%

Neither (slow but stable): 35%

Band: Elevated Risk